N1 million Presidential Palliative Loan – Apply Now!

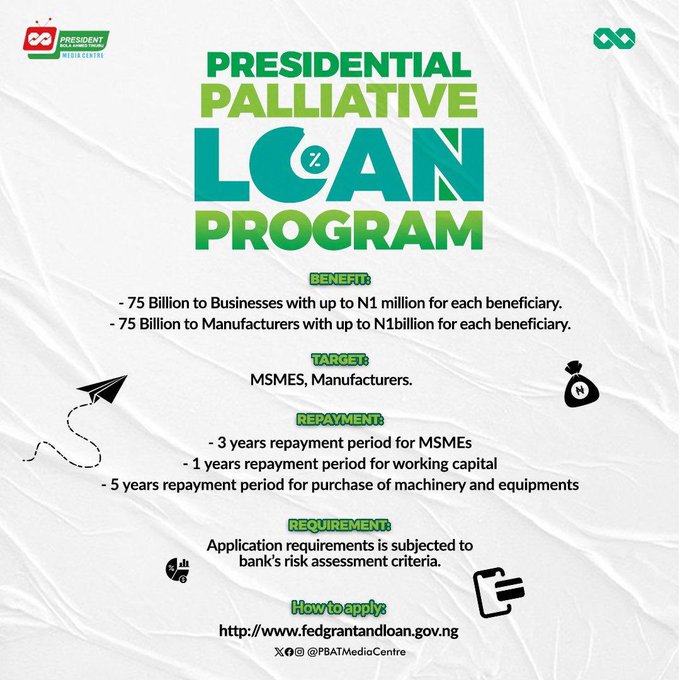

The Federal Government has recently initiated the Presidential Conditional Loan Scheme for businesses in Nigeria, including nano businesses, as part of the broader Presidential Palliative Program. This program aims to mitigate the impact of the removal of the fuel subsidy by President Bola Ahmed Tinubu on May 29, 2023.

Advertisements

According to the Presidency, the Presidential Conditional Loan Scheme represents a significant step in economic empowerment in Nigeria, revolutionizing financial support. Key features include a commitment to transparency and efficiency, leveraging digital transformation for accessible application processes through smartphones and computers, and providing financial literacy resources and training for effective fund management.

The scheme targets specific sectors, including traders, food services, ICT, transportation, creativity, and artisans. Eligible candidates can apply through the official website, https://loan.fedgrantandloan.gov.ng/. Disbursements will be handled by the applicants’ respective banks if they meet the eligibility criteria.

ALSO READ: ₦50k Government Loan Begins – 3,894 Youths To Benefit

The loan terms include a 36-month period for MSMEs, a 12-month term for manufacturers seeking working capital, and a 60-month tenor with a six-month moratorium for manufacturers applying for asset financing. The interest rate is set at 9% per annum, and legal measures will be applied in case of non-repayment.

Advertisements

Applicants must have a registered business (Sole Proprietorship, Partnership, or Limited Liability Company) to apply individually or with a partner company. There is no specified age limit for applicants, but they must be 18 years and above.

To apply, interested and qualified candidates can visit https://loan.fedgrantandloan.gov.ng/auth/loan-register. The application deadline is Sunday, December 31, 2023. The application process involves signing up with basic details, providing business information with the necessary documentation, detailing business leadership, and explaining how the loan will benefit their business.

Additional information is available at https://loan.fedgrantandloan.gov.ng/.